maryland ev tax credit form

The tax credit is available for all electric vehicles regardless of make or model and. Governor Mary Beth Tung Director.

What Is An Ev Tax Credit Who Qualifies And What S Next

When the Prologue and ZDX come to market for the 2024 model year theyll have a big advantage over competitors from HyundaiKia Toyota etc.

:focal(939x718:941x720)/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

. Tax Credits and Deductions for Individual Taxpayers. Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of. Up to 26 million allocated for each fiscal year 2021 2022 2023.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. By submitting this application the applicant will receive one of the following. Posting as a PSA to Marylanders on this thread.

Hogan Jr Governor Boyd K. Would apply to new vehicles. For every new ev purchased for use in the.

For every new ev purchased for use in the. Credit directly on the July property tax bill if the application is completed properly and is not subjected. Maryland Clean Cars Act of 2021.

On May 28 2021 Governor Hogan announced that he would allow a number of bills to become law without his signature. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. They may qualify for the 7500.

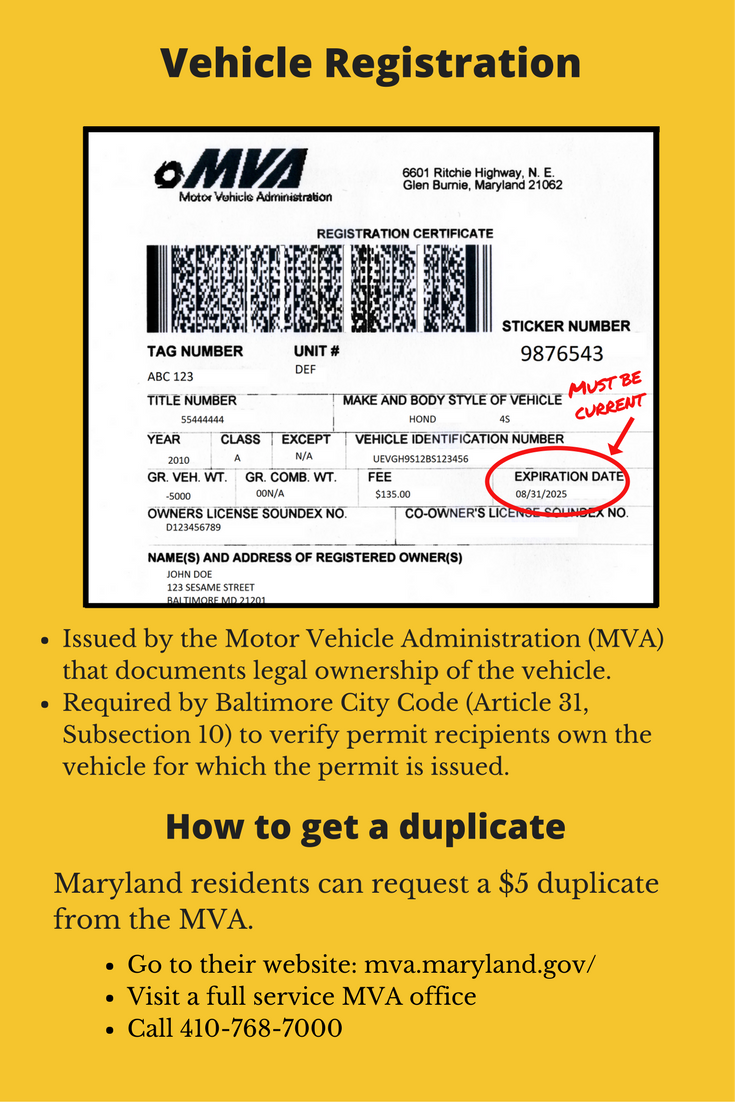

A whopping 90 of the energy consumed from transportation in the us comes from petroleum. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in. Residential Application Form Maryland Electric Vehicle Supply Equipment Rebate Program Lawrence J.

Tax Credits for EV Vehicle Purchases. Maryland Ev Tax Credit Form. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

Maryland Ev Tax Credit Form. HB1391 extends the expiring EV tax credit of 3000 when you purchase an EV but reduces eligibility by lowering the maximum cost. Maryland Excise Tax Credit The Maryland excise tax credit expired on June 30 2020 but could be funded in the future.

One of the bills on. The Maryland Electric Vehicle Tax Credit. However beneficiaries receiving this tax credit from a fiduciary must file electronically to claim a business tax credit unless the beneficiary happens to be a fiduciary taxpayer.

The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or. Tax credits depend on the size of the vehicle and the capacity of. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive.

A whopping 90 of the energy consumed from transportation in the us comes from petroleum. Will Fund Backlog of EV Tax Credit Applications. Under the proposed Clean Cars Act of 2021.

Jeep 4xe Hybrid Tax Credits Incentives By State

2022 Ev Incentives And Benefits In Bowie Md Nissan Of Bowie

Arcimoto Vehicles Reclassified As Autocycles In The State Of Maryland

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Required Customer Documents Parking Authority

New Ev Tax Credits For Tesla In The Inflation Reduction Act

Amazon Com Ev Wraps Maryland Hov Stickers Protection Film Automotive

Federal Ev Tax Credit Explained Youtube

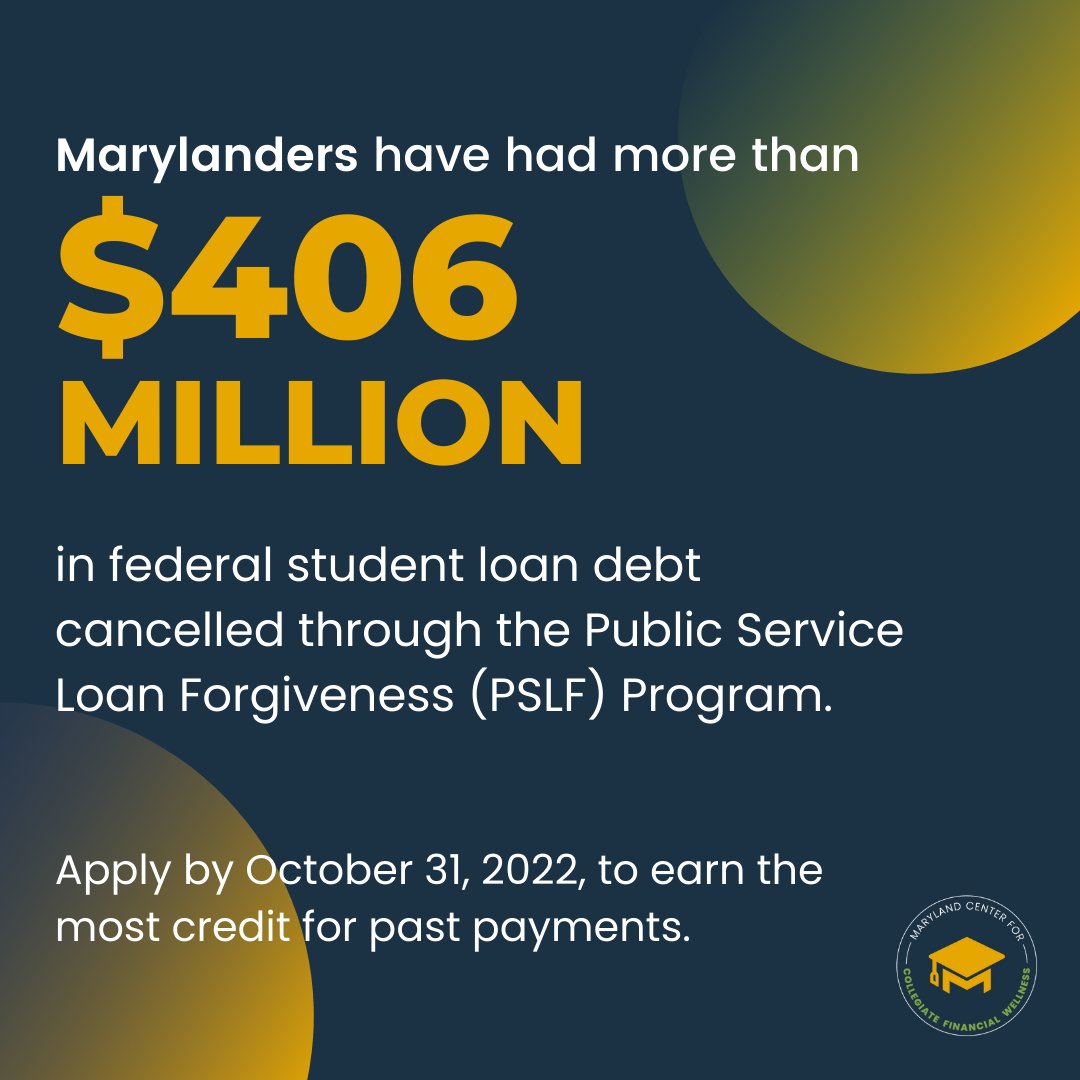

Maryland Center For Collegiate Financial Wellness Themccfw Twitter

Every Electric Vehicle Tax Credit Rebate Available By State

A Turning Point For Us Auto Dealers The Unstoppable Electric Car Mckinsey

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Harris Unveils Plan For Electric Vehicle Charging Network Ap News

Ev Charging Rebates Incentives Semaconnect

Electric Vehicle Charger Installation

Maryland State And Federal Tax Credits For Electric Vehicles Pohanka Hyundai Of Capitol Heights

Electric Vehicle Solar Incentives Tesla

Electric Vehicles Should Be A Win For American Workers Center For American Progress